By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

Arizona remains on a modest growth track, at least compared to the state’s long-run average. Even so, Arizona continues to add jobs and residents at a faster pace than the nation and most other states. The good news is that Arizona is well positioned to continue to grow, assuming the nation avoids recession, and the state is also likely to continue to outpace the nation. Gas prices remain well below year-ago levels, which will free up funds for household to use to shore up balance sheets and perhaps even finance additional purchases. The rapidly rising value of the U.S. dollar is a concern, because it may weigh on state export performance.

Arizona Recent Developments

The official employment benchmark has been released by the U.S. Bureau of Labor Statistics. As our internal analysis suggested, state employment growth fell short of 2.0% in 2014 (at 1.9%). Job gains last year also came in below the 2.3% rate posted in 2013. That pattern was reflected in both Phoenix and Tucson performance.

Much of the sluggish job growth last year was concentrated in the first half of 2014, with stronger gains in the second half. The state has maintained and even built on that momentum going into early 2015, but some of the strength is related to suspiciously large gains in education services and other services (which may not survive the next benchmark revision).

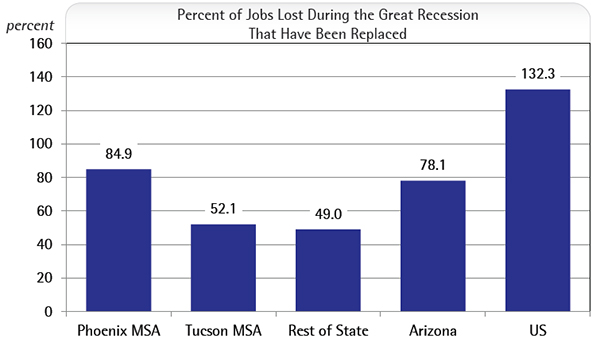

Taking a longer view, it is clear that Arizona jobs continue to recover. However, the state has yet to regain pre-recession employment levels. In other words, state jobs are still below the peak established just before the Great Recession. Using data through March 2015, Arizona has recovered 78.1% of the jobs lost during the downturn (Exhibit 1). In contrast, the U.S. has not only replaced all of the jobs lost during the recession, but has added an additional 32.3%. Note that the Phoenix Metropolitan Statistical Area (MSA) has replaced 84.9% of the jobs lost during the downturn, with Tucson at 52.1% and the rest of the state at 49.0%.

One factor holding back employment gains during 2014 was federal fiscal drag. This is related to the impact of the federal sequester on government activity, which began in 2013. These cuts have impacted growth in federal employment, as well as private sector jobs through reduced federal procurement spending (government purchases of goods and services from the private sector).

The decline in federal procurement spending has likely had a bigger impact on Tucson than Phoenix or the state as a whole. This is because federal government activity (both civilian and military) is a much bigger part of the Tucson economy than it is for the state overall or Phoenix. Indeed, federal activity accounted for 7.7% of Tucson’s GDP in 2012, compared to 1.9% for Phoenix, 3.9% for Arizona, and 3.8% for the U.S.

Arizona construction activity remains a concern, with slow employment, permit, and house price gains in 2014. Construction employment increased in 2014, but by just 1.4%, which followed a 6.6% increase in 2013. Likewise, housing permits rose in 2014 by 8.1%, after a 16.0% increase in 2013. All of the increase in permit activity was driven by gains in multi-family permits, which rose 46.2%. Single-family permits, in contrast, fell by 6.0% last year. Phoenix house prices, measured by the Case-Shiller index, rose by 6.6% in 2014, after a 19.6% increase in 2013. Overall, construction activity remains sluggish, held back by a variety of factors, including slow population and household growth.

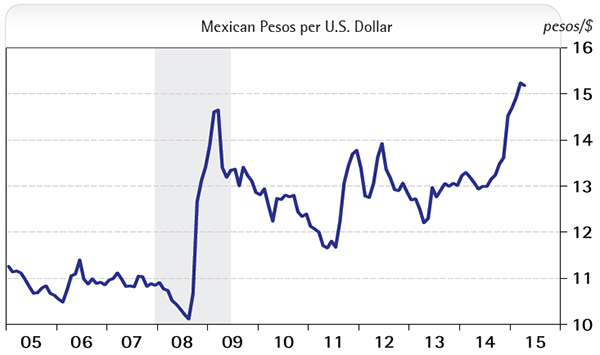

Another important price that has moved rapidly during the past six months is the trade-weighted exchange rate of the U.S. dollar. This has risen by 19.5% over the past year (through April) and now stands at its highest level since 2003. This matters for Arizona because merchandise exports have risen as a share of GDP since 2009. In addition, Mexico is by far the state’s largest export destination and the Peso/Dollar exchange rate has also been rising rapidly. Indeed, the Peso/Dollar exchange rate is at an all-time high, as Exhibit 2 shows. A strong dollar matters for trade, because it tends to decrease U.S. exports and increase imports, other things the same.

Arizona Outlook

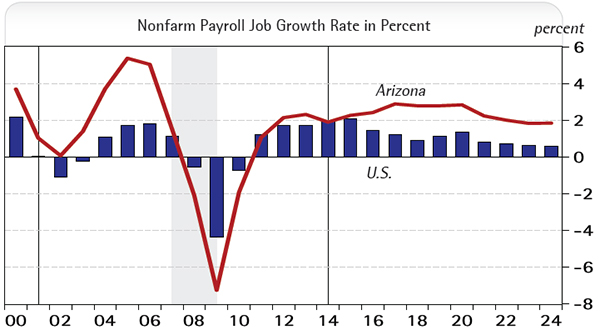

The slow growth that the state has experienced since the end of the Great Recession is expected to continue in 2015, with job, population, and income gains well below average growth during the 30 years before the downturn. However, as Exhibit 3 shows, state job gains are expected to come at a faster pace than nationally.

During the next three years, the state is forecast to add nearly 200,000 net new jobs. Most of those new jobs will be in the service-providing sectors, particularly professional and business services; education and health services; trade, transportation and utilities; and leisure and hospitality. These four sectors alone are expected to account for 73.5% of net job growth.

Construction is forecast to generate increased employment during the next three years, as the housing sector picks up a modest amount of steam. Manufacturing jobs are forecast to remain roughly stable, as is government employment.

Job growth contributes to increased net migration, which boosts overall population gains. State population gains rise from 86,200 in 2014, to nearly 130,000 per year by 2018. That translates into an acceleration of population growth from 1.3% in 2014 to 1.8% by 2018. Most of the population growth is expected in the Phoenix MSA. Tucson is forecast to post continued, but smaller, gains as well.

Stronger population gains boost housing activity in Arizona during the forecast. Housing permits are forecast to rise from 27,254 in 2014 to 46,171 by 2018. That reflects gains in both single-family and multi-family permits.

The forecast also calls for gasoline prices to gradually increase during the next 10 years. However, the rate of increase is expected to be fairly steady, with the price of gasoline in Phoenix rising from $2.23/gallon on average in 2015 to $3.13/gallon by 2019.

Browse EBRC’s latest economic forecast data for Arizona, Phoenix-Mesa-Glendale MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!

Photo of sailboat racing under Golden Gate Bridge on May 26, 2012 in San Francisco Bay courtesy of Shutterstock.