Arizona’s Second Quarter 2018 Economic Outlook Update*

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

June 1, 2018

Arizona added jobs, population, and income at solid rates last year. Jobs rose 2.4% in 2017, slower than gains in 2016, but above the national rate, and the state is keeping a similar pace so far in 2018. Population growth hit 1.5% and personal income rose 4.3% before adjustment for inflation. The Phoenix Metropolitan Statistical Area (MSA) remained the engine of growth in Arizona, but the Tucson MSA has generated gradually improving growth during the last two years. Overall, the state is in good shape as we look forward to 2018 and 2019.

A forecast of continued national growth sets the stage for Arizona to continue to expanding. The state is forecast to add jobs, residents, and income next year at a pace similar to recent results Statewide jobs are forecast to rise by 69,700, which translates into 2.5% growth. That’s well above the expected national rate of 1.7%. Job gains drive population increase, and Arizona will add 112,800 net new residents. With tightening labor markets, Arizona income gains accelerate 5.2% this year.

Even though the baseline forecast calls for continued economic gains for the U.S., Arizona, Phoenix, and Tucson economies, it is important to consider risks to the outlook. With expansionary fiscal policy coming during a time of tight labor markets, inflation is likely to be more of a concern as we move into 2019 and 2020. This will put a premium on the judicious use of monetary policy. Stay tuned.

Arizona Recent Developments

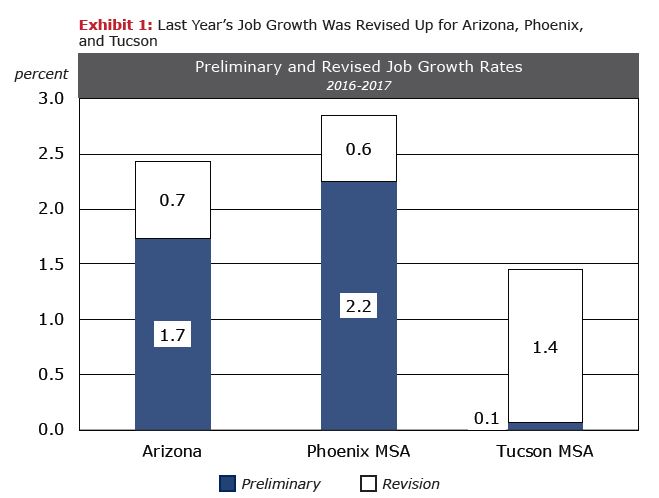

The U.S. Bureau of Labor Statistics released their annual benchmark revisions of job data in March. As EBRC expected, based on our rolling benchmark, the new data suggested stronger growth in 2017 for Arizona, the Phoenix MSA, and the Tucson MSA. As Exhibit 1 shows, statewide job growth in 2017 was revised up from 1.7% to 2.4%. The revised data showed that the state added 64,100 jobs last year. Even with the upward revision, state job growth decelerated last year, compared to the 2.7% rate in 2016. Arizona continued to outpace the national rate of 1.6%.

The revised data also showed that the Phoenix MSA added jobs at a faster pace last year (2.8%), compared to the preliminary rate (2.2%). As discussed in recent Forecasting Project Sponsors meetings, the upward revision in the Tucson MSA was particularly striking. Preliminary estimates suggested growth of just 0.1% last year. In contrast, the EBRC benchmark indicated that Tucson was doing much better. The revision showed that EBRC was correct. The Tucson MSA added jobs at a solid 1.5% clip last year, close to the national average and the fastest pace since 2012.

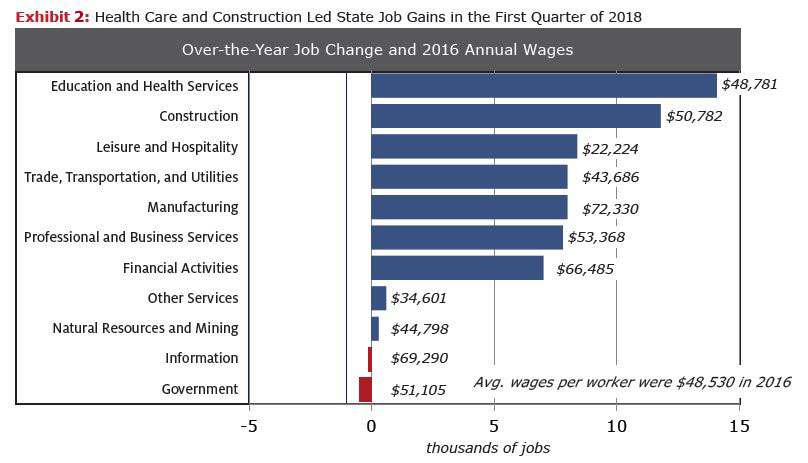

Exhibit 2 shows Arizona’s over-the-year job gains by industry in the first quarter, as well as, 2016 average wages. Overall, the state added 65,400 jobs for 2.4% growth. Seven out of 11 industries accounted for nearly all job gains over-the-year. Education and health care and construction led the charge, followed by leisure and hospitality; trade, transportation and utilities; manufacturing; professional and business services; and financial activities. Government and information jobs were down slightly.

Manufacturing job gains over the year were concentrated in durables, particularly other durable manufacturing and computer and electronic products.

On the international trade front, renegotiation of NAFTA continues while the administration threatens large tariffs on steel and aluminum (and other goods) imports from abroad. Arizona’s exports to Mexico (our largest export destination) remain far below peak (2015) levels. However, data for the fourth quarter of 2017 and the first quarter of 2018 suggest modest stabilization after two years of decline. In other encouraging news, legal northbound pedestrian and vehicle passenger crossings through Arizona’s border ports began to increase at a faster clip during 2017. However, the U.S. dollar remains strong against the Mexican peso, at 18.4 pesos per dollar in April, which was 41.4% above June 2014.

Crude oil gasoline prices continued their upward march in the first quarter, with the Brent crude oil price reaching $66/barrel in March. That was up 115% from January 2016, the recent low point. Gas prices in the Phoenix MSA hit $2.70 in April, up 65.5% from the recent low in March 2016.

Arizona Outlook

The forecasts for Arizona, Phoenix, and Tucson depend on assumptions about the U.S. and global economies. In turn, these assumptions (forecasts) come from IHS Markit, a global macroeconomic forecasting firm. The baseline forecast for the U.S. and global economies was created in April 2018. It calls for the U.S. to continue to grow during the next decade. Growth initially accelerates, driven in part by the recent fiscal stimulus, but then slows as demographic forces reassert themselves.

Real Gross Domestic Product (GDP) is expected to accelerate from 2.3% this year to 2.7% in 2019 and then to 2.9% in 2020. Thereafter, growth slows to the 1.6%-1.8% range through 2027. The acceleration is driven in part by stronger gains in household consumption, reflecting increased disposable income as tax cuts and low unemployment rates translate into increased purchasing power. Corporate tax cuts, coupled with stronger growth, contribute to increased investment spending on structures and equipment. Increased federal spending (for both defense and non-defense purchases) also contributes to gains through 2020.

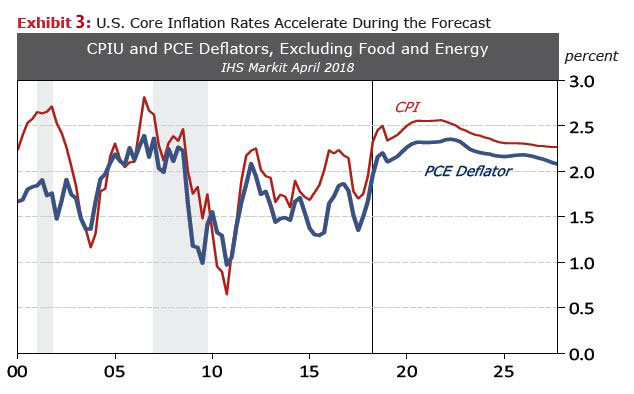

Accelerating real GDP gains come during a period of relatively tight labor markets, with the U.S. unemployment rate expected to fall from 4.4% last year to 3.9% this year and then again to 3.6% by 2019. This sets the stage for accelerating inflation. Exhibit 3 shows core inflation rates (excluding the volatile food and energy components) for the CPIU and Personal Consumption Expenditures deflator. Inflation measured by these indexes is expected to rise above the Federal Reserve’s target rate of 2.0% this year and remain modestly above that objective through 2027. The U.S. economy is forecast to experience higher rates of inflation than we have seen during the previous decade.

This sets the stage for the Federal Reserve to continue increasing the target federal funds rate range, which now stands at 1.5%-1.75%. The forecast calls for three more rate hikes this year and additional hikes in coming years, with the rate expected to hit 3.5% in 2020. That drives long-term interest rates up, with the 30-year conventional mortgage rate forecast to rise from 4.0% last year to 5.3% by 2020.

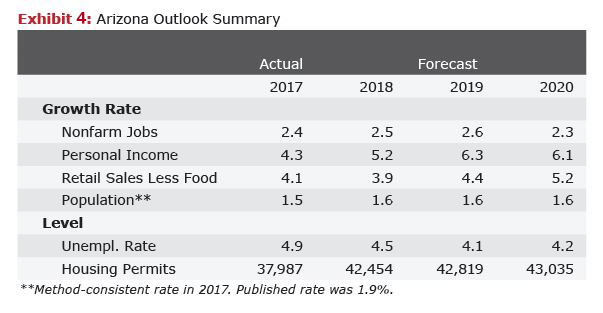

With the national economy forecast to generate steady gains, Arizona, Phoenix, and Tucson continue to expand as well. Exhibit 4 summarizes the forecast for Arizona. Job growth is expected to rise slightly during the next two years, reflecting stronger national growth. Arizona jobs are forecast to increase by 2.5% in 2018, 2.6% in 2019, and 2.3% in 2020. Those gains are expected to significantly outpace national growth.

Continued steady job gains, and a gradually declining state unemployment rate, translate into faster wage gains during the forecast. That, in turn, spurs improved personal income growth, which is forecast to accelerate from 4.3% last year, to 5.2% this year, and then to 6.3% in 2019 and 6.1% in 2020.

Improved growth in income means stronger growth in retail sales, which is forecast to accelerate from 4.1% last year to 5.2% by 2020.

Improved job gains generate a modest improvement in population growth, which rises to 1.6% this year and stabilizes in that range through 2023.

Population gains trigger improved housing permits activity in the near term, but total permits stabilize in the 43,000 per year range by 2020.

*Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!