Second Quarter 2021 Forecast Update

By George W. Hammond, Ph.D., Director and Research Professor, Economic and Business Research Center

May 2021

The Arizona economy continues to recover from the pandemic, but progress has been uneven. The travel and tourism sector is improving, but still has a long way to go. Transportation and warehousing continues to add jobs at a rapid pace, thanks to accelerated online shopping and demand for delivery services. Fiscal stimulus has driven strong income growth, which boosted consumer spending, but that will end later this year. House prices continue to surge, driving down affordability. Arizona’s population rose at a faster pace than most states during the past decade, but growth was slow relative to the past.

The outlook for the state remains positive, but the pandemic will still influence the pace of recovery. The baseline forecast assumes that vaccine distribution continues to go well and that no vaccine-resistant variants emerge. The baseline projections call for state jobs to regain their pre-pandemic peak in the first quarter of 2022 and to increase by 643,000 over the next decade. The pessimistic scenario calls for that to happen in the third quarter of 2022 and for the state to add 577,000 jobs by 2030. The optimistic scenario calls for Arizona jobs to regain their pre-pandemic high in the fourth quarter of 2021 and to rise by 778,000 during the next decade.

Arizona Recent Developments

Arizona added 759,485 residents from 2010 to 2020 according to the latest decennial count from the U.S. Census Bureau. That translated into growth of 11.9% during the decade, which outpaced the U.S. at 7.4% and ranked the state 10th in the nation (including DC). Utah ranked first with 18.4% growth, while West Virginia ranked last with a decline of 3.2%.

While Arizona’s population growth was faster than most states and the nation, it was very slow compared to our own past history. Population growth of 11.9% was the slowest pace recorded since (at least) 1900. It was the second slowest pace for the nation. Note that it is possible that the slow growth may be due in part to a Census undercount driven by the disruptions caused by the pandemic. Stay tuned for more analysis on that.

Let’s turn from demographics to the labor market. After a loss of 331,500 jobs from February to April 2020, Arizona has generated 236,700 new jobs through April 2021, for a replacement rate of 71.4%. That was better than the U.S. replacement rate of 63.3%, but still left state employment 94,800 jobs shy of our pre-pandemic peak. In other words, Arizona jobs were 3.2% below our pre-pandemic peak in April 2021.

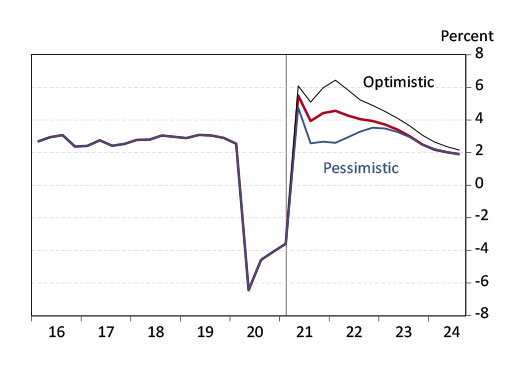

Leisure and hospitality jobs remain hardest hit (Exhibit 1), with employment down 45,900 from February 2020, followed by government (down 24,100), professional and business services (down 17,000), and education and health services (down 8,300). Only trade, transportation, and utilities jobs were up from February of last year (by 16,400), with all of that growth concentrated in transportation and warehousing.

Exhibit 1: Arizona Leisure and Hospitality Jobs Remain Hardest Hit

Arizona Net Job Change from February 2020 to April 2021, Thousands of Seasonally-Adjusted Jobs

As of April 2021, Arizona’s rate was 6.7%, seasonally adjusted. That was slightly above the U.S. rate of 6.1%. The difference was not statistically significant. Arizona’s rate in April was far below its pandemic high in April of 14.2% but above its February 2020 level of 4.9%.

An alternative measure of labor market tightness is the employment-to-population ratio. Arizona’s seasonally-adjusted ratio was 56.3% in April 2021. That was above its April 2020 low of 52.1% but was still below its February 2020 level of 58.6%.

Overall, there appears to be significant slack in the state labor market. If that is true, why all the discussion of labor shortages? There are likely many factors at work here. One factor is that the aggregate data hides imbalances across industries. In other words, there are likely industry-specific shortages, particularly in sectors hardest hit by the pandemic. Further, many of these sectors pay low wages that are not competitive in the current environment, which features greatly increased generosity of unemployment insurance (primarily through federal programs), limited child-care options, continued fears about contracting the coronavirus, and accelerated retirement of older workers due to the pandemic. Some of these factors are temporary and will dissipate soon. Others will create a longer-lasting drag on job growth.

Construction job growth has been weak during the past year. However, housing permit activity has been robust. Even so, house prices continued to rise at a rapid rate in the first quarter of 2021. The Phoenix MSA median house price rose by 25.4% over the year in April. The Tucson MSA median house price rose even faster, at 22.4%. House price increases of this magnitude will adversely impact affordability going forward.

For the year, Arizona personal income rose 8.4% in 2020, according to these preliminary estimates. That outpaced the national rate of 6.1%. Arizona net earnings from work rose by 3.5%, while transfer receipts increase by 32.4%. Income from dividends, interest, and rent fell by 0.9% over the year. Personal income less transfers rose by 2.4% in 2020.

The federal CARES Act had a huge impact on state personal income in 2020. Overall, current BEA estimates suggest that Arizona transfer receipts via the major CARES Act provisions totaled $18.5 billion in 2020. Expanded unemployment insurance coverage totaled $8.1 billion, Paycheck Protection Program grants totaled $4.1 billion, Economic Impact Payments (stimulus checks) totaled $6.0 billion, and other smaller programs totaled $360 million.

Arizona taxable retail sales (plus remote sales) remained strong through February 2021, up 16.7% from January 2020. Taxable sales on services like restaurants and bars, hotels and motels, and amusements remained far below pre-pandemic levels. Taxable sales at restaurants and bars in February was down 6.8%, while hotel and motel sales were down 43.1% and sales in the amusements category were down 27.1%.

Arizona Outlook

Arizona’s economic performance depends in part on the U.S. and global economies. Likewise, the state forecast depends on a forecast for the U.S. economy from IHS Markit which was produced in April 2021.

The baseline forecast calls for U.S. real GDP to rise by 6.2% in 2021, 4.3% in 2022 and then decelerate to near-trend growth just over 2.0% in 2023-2024.

Nonfarm payroll jobs nationally dropped by 5.7% in 2020, but rebound in 2021 with growth of 3.1% in 2021 and 2022.

The unemployment rate peaked at 8.1% for the year in 2020, then declines to 5.2% in 2021 and 3.8% in 2022.

Inflation gathers modest momentum during the near term, with average price increases of 2.4% in 2021 and 1.5% in 2022.

Housing starts surged in 2020 to 1.40 million units. Activity rises to 1.55 million in 2021, before softening to 1.27 million by 2023.

The outlook for Arizona calls for accelerating growth through 2022, as Exhibit 2 shows. State jobs are forecast to rise by 2.5% this year, 4.2% in 2022, and 3.2% in 2023. Jobs regain their first quarter 2020 peak in the first quarter of 2022.

During the next two years, leisure and hospitality; trade, transportation, and utilities; professional and business services; and education and health services add the most jobs. Together these four sectors account for just over three-quarters of total job gains. Through 2030, these four sectors are forecast to account for 79.4% of job gains.

Construction jobs are forecast to increase by 12,000 from 2020 to 2022, reflecting increased residential activity. Housing permits are projected to rise by 2,300 in 2021 and 3,200 in 2022, before they decelerate to a pace consistent with net population change.

The forecast calls for the Arizona labor market to rapidly tighten as the pandemic ends. The state unemployment rate is projected to fall from 7.9% last year to 5.8% in 2021, to 4.3% in 2022, and to 4.0% in 2023.

Exhibit 2: Arizona Outlook Summary

Arizona personal income growth decelerates modestly in 2021, after very strong gains in 2020. Even so, income growth is strong in 2021, reflecting the major injection of federal fiscal stimulus. Without fiscal stimulus in 2022, income growth decelerates significantly and returns to normal by 2023.

Retail sales (including remote sales) decelerates in 2021 and 2022, reflecting both slowing income gains and the diversion of some spending from goods into travel and tourism activities.

Overall during the next decade, Arizona is forecast to add 643,000 new jobs. The Phoenix MSA is expected to continue to drive state economic gains during the forecast and adds 576,000 jobs. The Tucson MSA contributes as well, but at a slower pace, adding 53,000 jobs.

Risks to the Outlook

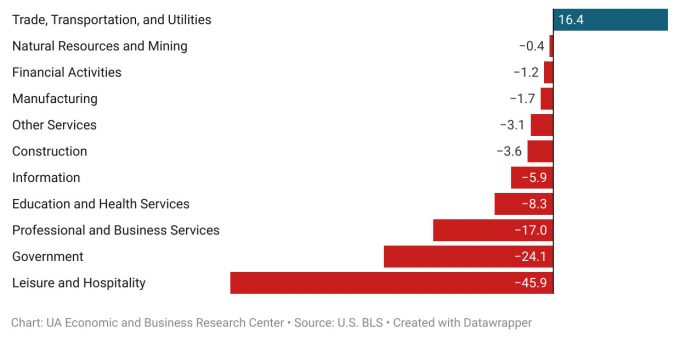

While the trajectory of the economy is likely to trend upward in the near term, assuming the outbreak continues dissipate, there are risks to the outlook. Exhibit 3 shows Arizona job growth under three scenarios. The baseline projections are assigned a 50% probability. The upside and downside risks are equally weighted, at 25% each.

The pessimistic scenario assumes a resurgence of the outbreak driven by a new variant. Containment measures are reintroduced, slowing consumer spending and delaying recovery. Under these assumptions, Arizona jobs return to their pre-pandemic peak in the third quarter of 2022 and adds 577,000 new jobs during the next decade.

The optimistic scenario assumes a more robust response to fiscal stimulus (more funds spent sooner) and a more rapid end to the pandemic driven by rapid vaccine uptake and adherence to mask wearing. Under these assumptions, Arizona jobs return to their pre-pandemic peak in the fourth quarter of 2021 and adds 778,000 new jobs during the next decade.

Exhibit 3: The Odds Favor Continued Rapid Recovery of the Arizona Economy

Arizona Over-the-Year Job Growth Under Alternative Scenarios