by George Hammond

EBRC director and Eller research professor.

The $600 weekly supplement not only returned spending by recipients to pre-pandemic levels, but also provided direct stimulus to aggregate spending

Much of the discussion about the economic impact of the CARES Act provisions on unemployment insurance has focused on the work disincentives of the $600 increase to the regular weekly benefit. However, that has not been the only impact of expanded benefits.

Pandemic Unemployment Assistance benefits in Arizona totaled $4.2 billion from mid-May through July 11, with an additional $2.2 billion from the regular unemployment benefits since early March. To put that in perspective, total benefits paid since early March were 1.9% of Arizona’s personal income in 2019. These benefits have no doubt contributed to consumer spending, taxable sales, and income tax revenues.

The JPMorgan Chase Institute recently published an interesting report attempting to pin down how much the expanded unemployment insurance benefit has contributed to spending. They used a large sample of households with Chase deposit accounts, including account holders in Arizona and nine other states. They compared account flows (a rough proxy for spending) across individuals who received direct deposits of UI benefits and those that did not. Keep in mind that UI benefits may be received either as direct deposits or as prepaid debit cards.

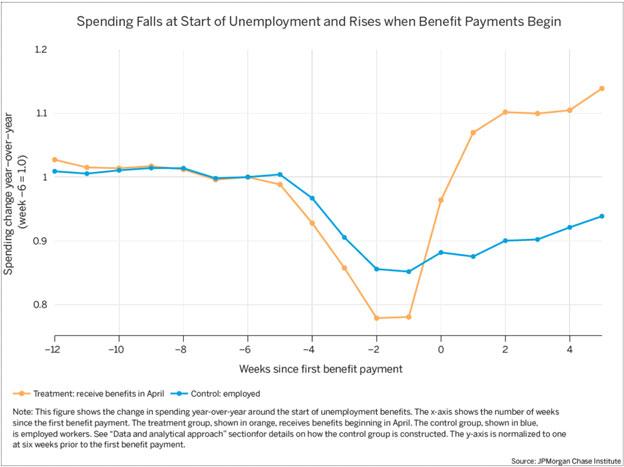

Exhibit 1 summarizes their main result. It shows the year-over-year change in spending for individuals that received UI benefits compared to those that did not. Note that spending for both groups declined initially, relative to pre-pandemic levels. It declined more for individuals that were unemployed. Once benefits were received however, spending for unemployed individuals rebounded strongly to levels above pre-pandemic activity.

Exhibit 1: Spending Falls at Start of Unemployment and Rises when Benefits Begin

This suggested that the $600 weekly supplement not only returned spending by recipients to pre-pandemic levels, but also provided direct stimulus to aggregate spending.

It also suggested that if Congress wishes only to return spending to pre-pandemic levels, a reduction in the supplement would be appropriate. JPMI estimates that a $350 weekly supplement would be appropriate to accomplish that goal.

Further, this research suggested that if the supplement is simply allowed to expire at the end of July, with no offsetting stimulus through other channels, we could experience a significant decline in household spending. That would ripple across the economy.

A useful reference point is Ganong and Noel (2019) who found that unemployed households typically reduce spending by 7% relative to employed households.

Follow unemployment and pandemic assistance weekly claims on Arizona’s Economy.