Arizona’s Third Quarter 2018 Economic Outlook Update*

By George W. Hammond, Ph.D.

Director and Research Professor, EBRC

September 1, 2018

More than nine years into the current expansion, Arizona continues to post solid growth in jobs and income. The Phoenix Metropolitan Statistical Area (MSA) remains the engine of state job gains, but Tucson is contributing as well. All major industries in Arizona added jobs during the past year, with construction employment finally firing on all cylinders. Housing permits are up, but not enough to restrain rapid house price increases. Overall, the state housing market is not yet in the red zone, but housing affordability will become more of a concern in the near future.

In the long run, Arizona remains well positioned to outpace the nation and most states in job, income, and population growth. Tucson is likely to outpace the U.S. during the next 30 years, but fall well short of growth rates posted by Phoenix. The state’s standard of living will continue to rise, even after accounting for inflation. However, Arizona will not make much progress in closing the per capita personal income gap with the nation without significant improvement in college attainment.

Arizona Recent Developments

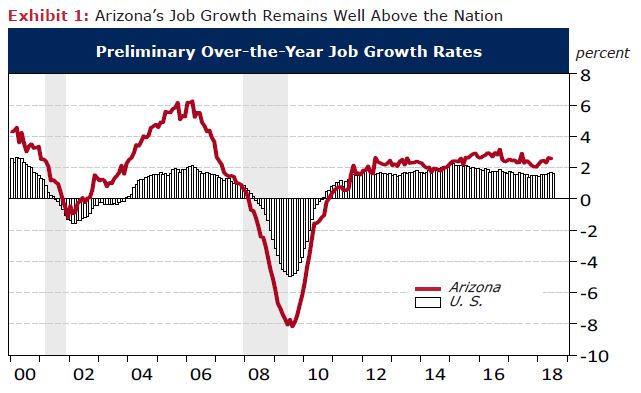

Arizona added jobs at a solid clip in the second quarter, with 69,500 net new jobs over the year, according to preliminary estimates, or 2.5% growth. This is slightly faster than last quarter’s pace of 2.4% and well above the U.S. pace of 1.6%. As Exhibit 1 shows, Arizona’s job growth has been well above the U.S. average since late 2014.

The Phoenix MSA continues to drive state job gains. Phoenix employment increased by 60,400 over the year in the second quarter, for 3.0% growth. The Tucson MSA posted gains close to the national rate, with jobs rising by 6,200, or 1.6%.

One big change in Arizona’s labor market during the past year has been the resurgence of construction job growth, which is now rising at rates last seen in early 2006 (around 10% over the year), according to the preliminary monthly data. Likewise, statewide housing permits continue to increase at a solid pace. Through the first six months of this year, Arizona total permits were up 8.5%, compared to the same period in 2017. That reflected a 12.6% increase in single family permits. Multi-family permits were down 2.1%.

Phoenix MSA housing permits were up 12.6% through June, with gains in both single and multi-family activity. Tucson MSA permits have fallen 6.9% so far this year, driven by a decline in multi-family activity (which was extremely strong last year). Single-family permits were up strongly, increasing 19.6%.

Rising house prices in Arizona are putting downward pressure on housing affordability. However, Phoenix and Tucson affordability is now back to levels last seen in the early 2000s. The state housing market is not in the red zone, but it is headed toward increasing affordability issues.

Arizona Outlook in the Long-Run

The long-run outlook for the nation calls for average growth rates during the next 30 years to fall below the pace set during the previous 30 year period. Demographic pressures, principally the aging of the baby boom generation, cause the slowdown nationally and across Arizona.

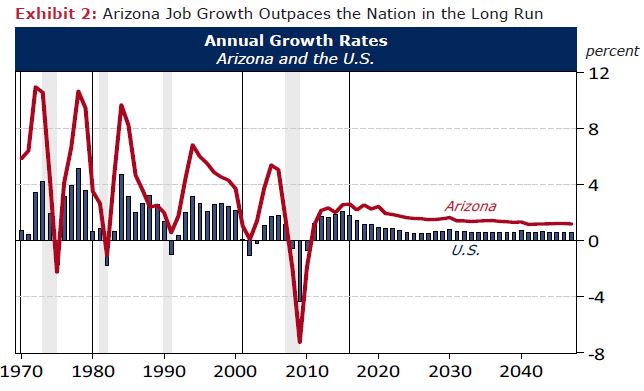

Arizona job growth is forecast to average 1.4% per year during the 2018-2048 period. That is more than double the national rate of 0.6% per year, as Exhibit 2 shows, but well below growth during the previous 30 year period of 2.3% per year. Overall, state jobs rise from 2.85 million in 2018 to 4.38 million in 2048.

Job gains contribute to Arizona’s income growth, complemented by increases in asset income (dividends, interest, rent) and transfer receipts. Inflation-adjusted personal income rises at an average pace of 2.9% per year during the forecast, above the national pace of 2.2% per year, but again below the pace set during the three previous decades (3.2% per year).

Arizona’s population rises from 7.1 million in 2018 to 10.2 million by 2048. That translates into average growth of 1.2% per year, double the national pace of 0.6% per year, but well below average growth during the previous 30 years (2.4% per year). The deceleration in population growth is driven by demographic aging, which puts downward pressure on natural increase (births minus deaths).

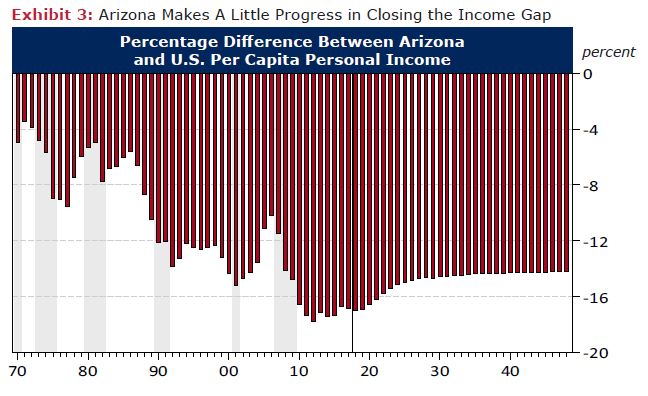

On a per capita basis, real personal income continues to rise at a solid pace during the next 30 years at 1.7% per year. That is slightly above the national pace of 1.6% per year. Another way to express Arizona’s growth relative to the U.S. is to compute the per capita income gap. Exhibit 3 shows the percentage difference between Arizona and U.S. per capita personal income from 1970 to 2048.

Arizona has fallen far behind the U.S. during the past 30 years, with the gap rising from the 4.0% range during the early 1970s to the 16.0%-17.0% range recently. The forecast suggests that we may see stabilization and even some small improvement during the next 30 years, with the gap descending to around 14.0% by 2048. Even so, that is still a large difference and it is unlikely that Arizona will significantly close the income gap without major improvements in the college attainment rate relative to the nation.

Risks to the Outlook

Risks to the long-run projections depend on supply-side factors, like demographics, educational attainment, infrastructure, and resource constraints more generally. Demographics will slow growth in the long run, because the retirement of the baby boom generation will reduce labor force growth. Similarly, Arizona’s middling college attainment rates, if they do not improve, will limit the state’s economic competitiveness. It will pinch the state’s ability to generate the kinds of high-skill jobs that will garner above average wages. Further, infrastructure will matter for the state’s future growth. Key investments in highways and roads, water and sewer, air transport, telecommunications, and border ports will be necessary. Finally, natural resources, principally water, will need to be carefully monitored and managed to accommodate future growth.

*Forecast data for Arizona, Phoenix MSA, and Tucson MSA.

Need to know more?

Contact George Hammond about the benefits of becoming a Forecasting Project sponsor!