The December 2020 employment numbers are in and Arizona has replaced 69.4% of the 294,600 jobs lost from February to April 2020.

By George W. Hammond, EBRC director and Eller research professor

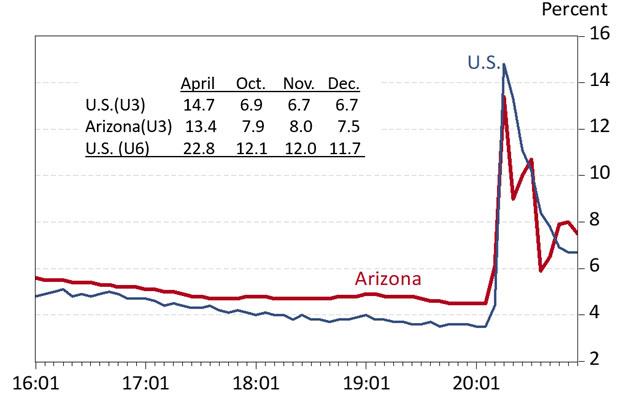

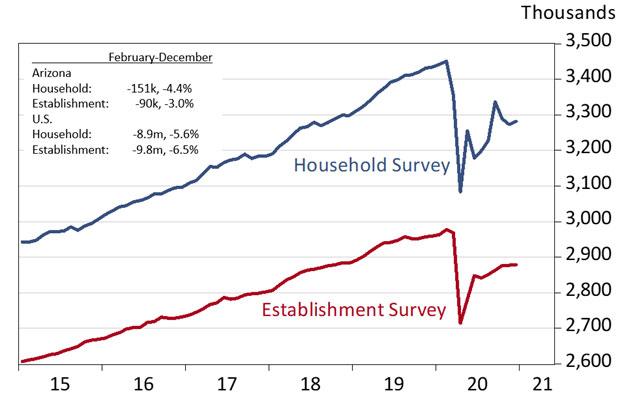

January 24, 2021 – Arizona added 900 jobs over the month in December on a seasonally-adjusted basis, according to the latest preliminary data from the Bureau of Labor Statistics’ establishment survey. That was the smallest gain since the recovery began in May. Employment measured by the household survey rose by 21,800 on a seasonally-adjusted basis, but as Exhibit 1 shows, this series has been extremely volatile.

Arizona jobs remained 90,100 below the peak in February. That is a gap of 3.0%, which is better than the nation, where jobs were 6.5% below February. Arizona employment measured by the household survey was 150,700 below February for a gap of 4.4%.

On an annual average basis from the establishment survey, Arizona jobs declined by 66,600 from 2019 to 2020. That translates into a 2.3% decline. Jobs in the Phoenix MSA declined by 42,400 or 1.9%. Jobs in the Tucson MSA declined by 11,300 or 2.9%.

Exhibit 1: Arizona Employment Measured by the Establishment and Household Surveys, Seasonally Adjusted

As of December, Arizona replaced 69.4% of the 294,600 jobs lost from February to April. That was better than the U.S., which replaced 55.6% of the jobs lost from February to April.

Since June, Arizona’s over-the-month job growth averaged 11,000 per month. That is a rapid rate. During the 2015-2019 period, the state’s monthly job gain averaged 6,200. If the state can sustain its average pace since June, we will be back to the February peak in September 2021. If job growth returns to its pre-pandemic pace, the state will return to its February peak in March 2022.

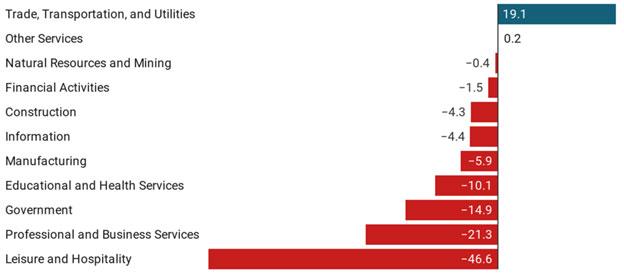

As Exhibit 2 shows, trade, transportation, and utilities jobs were 19,100 above their February level. This reflected strong gains in transportation and warehousing, as well as trade. These sectors were boosted by the huge infusion of federal funds through the CARES Act, re-directed demand from travel and tourism, as well as accelerating trends favoring online shopping and delivery.

Leisure and hospitality jobs remained the hardest hit, accounting for just over half of the job gap since February. Professional and business services; government; and educational and health services also remain far below February. Keep in mind that nearly all major sectors of the state economy are still below their February level.

Exhibit 2: Arizona Job Change from February to December by Major Industry, Seasonally Adjusted

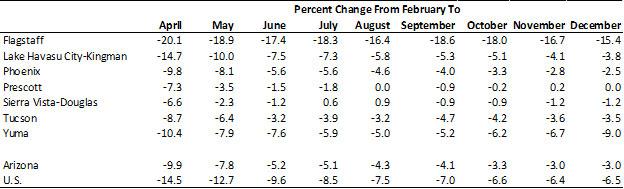

Arizona’s recovery has not been evenly spread across the state’s metropolitan areas. As Exhibit 3 shows, Flagstaff remained the furthest below its February peak, followed by Yuma, Lake Havasu City-Kingman, Tucson, Phoenix, and Sierra Vista-Douglas. The Prescott metro area has been close to its February peak since October.

Further, Phoenix is completely responsible for the state’s job growth since June. The other metropolitan areas have generated little or no job growth.

Exhibit 3: Arizona Metropolitan Area Job Growth, Relative to February, Seasonally Adjusted

Arizona’s unemployment rate fell from 8.0% in November to 7.5% in December (seasonally adjusted). As Exhibit 4 shows, the state rate has been exceptionally volatile this year. Overall, the state rate can be safely said to have fallen from its April peak, but it is not at all clear by how much.

Exhibit 4: Arizona and U.S. Unemployment Rates, Seasonally Adjusted