By George W. Hammond, EBRC Director and Eller Research Professor

Tucson experienced a small net inflow into urban neighborhoods during the pandemic, while Phoenix experienced a small net outflow…

During the past year, media reports have trumpeted the great COVID-19 migration. Thanks to research from the Federal Reserve Bank of Cleveland (FRBC), we now know a bit more about the scope and scale of recent changes to migration patterns.

Using the Federal Reserve Bank of New York/Equifax Consumer Credit Panel, a series of data reports found that migration patterns were significantly disrupted by the pandemic. The data resulted from a nationally representative anonymous random sample of 5 percent of U.S. consumers with a credit score (10 million adults). Since 9 out of 10 adults have credit records, the author argues that these data are more representative than many datasets underpinning media reports to date. The data also reflect address changes reported monthly and geolocated to Census tracts.

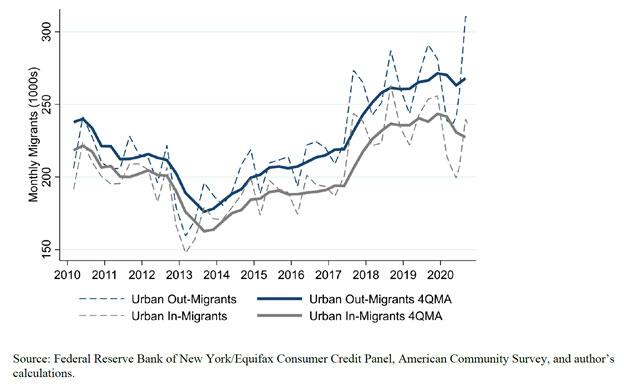

A significant increase in net out-migration from urban neighborhoods during the pandemic was evidenced in the survey results. Indeed, the data suggested that net outmigration from urban neighborhoods doubled after March 2020. However, as Exhibit 1 shows, that was driven primarily by a drop in gross migration flows into urban neighborhoods, not so much by gross flows out of urban neighborhoods.

Exhibit 1: Estimated Gross Migration Into and From Urban Neighborhoods

The FRBC also reported urban net out-migration increased more for high-income individuals, renters, young people (age 18-34), and for residents within large (+5 million residents) and medium-sized (2-5 million residents) metropolitan areas. Further, net urban out-migration increased for regions with higher COVID-19 death rates, more teleworkers, more small-business closures, and higher homicide rates.

Across metropolitan areas with more than 500,000 residents, Bridgeport, Connecticut; San Francisco, California; San Jose, California; and New York, New York metropolitan areas had the largest increases in net outflows from urban neighborhoods (relative to total population). Modesto, California; El Paso, Texas; Spokane, Washington; Indianapolis, Indiana; and Salt Lake City, Utah experienced net increased migration flows into urban neighborhoods.

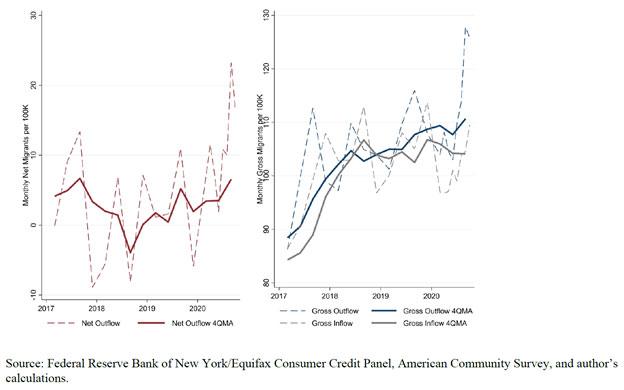

Tucson experienced a small net inflow into urban neighborhoods during the pandemic, while Phoenix experienced a small net outflow (Exhibit 2). No exhibit was provided by the author for Tucson.

Exhibit 2: Estimated Gross and Net Migration Into and Out of Urban Neighborhoods: Phoenix MSA

Our “High-Cost Metro Edition” of this article discusses a related Federal Reserve Bank of Cleveland report on migration patterns across metropolitan areas in the U.S. during the pandemic.